Shifting Market: From Miami to Denver, the Return of Buyer’s Markets Signals a Healthier, More Sustainable Real Estate Environment

After several years of intense competition and record-breaking prices, America’s housing market is beginning to shift. According to Realtor.com’s latest report, major metropolitan areas—including Miami, Denver, Nashville, and Houston—are transitioning from seller-dominated markets to buyer-friendly territory.

Albert Dweck of Duke Properties views this transformation as a healthy and encouraging development for long-term market stability. “Balanced conditions are essential for sustainable growth,” Dweck explains. “A market where both buyers and sellers can negotiate fairly leads to smarter investments, better living conditions, and stronger communities.”

In recent months, the months of supply metric—a key indicator of whether the market favors buyers or sellers—has climbed above six months in several cities. This means more homes are available and buyers have more choices, bringing relief to many who were priced out in recent years.

Dweck emphasizes that market corrections like these are not setbacks, but rather natural recalibrations after years of overheated demand. “Every healthy market goes through cycles,” he says. “When supply expands and pricing pressure eases, it invites a new wave of qualified buyers, investors, and families to enter the market with confidence.”

Cities like Miami and Orlando have led the trend, offering buyers more inventory and leverage. Realtor.com data shows Miami now has a ten-month supply of homes—up significantly from last year—while Orlando saw its inventory rise to nearly nine months. Meanwhile, Denver, Nashville, and Raleigh are also showing higher supply levels, creating room for negotiation and opportunity.

For Duke Properties, this national trend represents a moment of optimism and strategic potential. “We’ve always believed in patience, discipline, and timing,” Dweck notes. “The current environment rewards buyers and investors who think long-term—who look beyond short-term headlines and focus on value creation.”

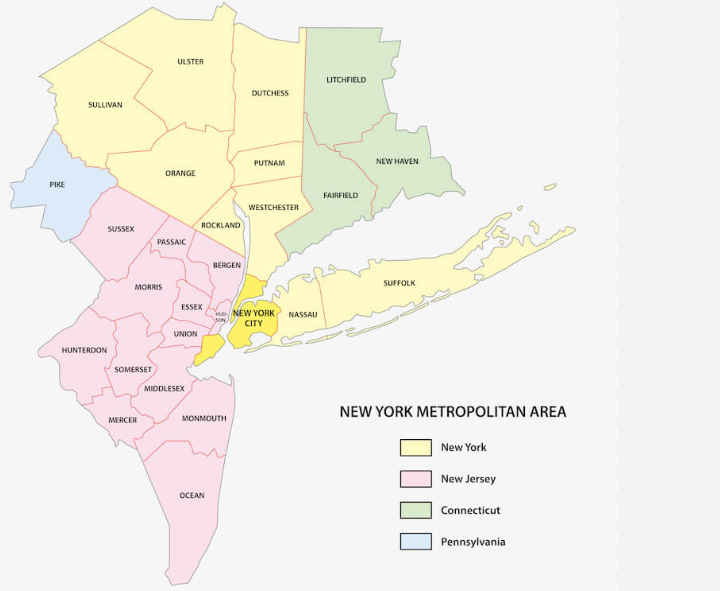

He adds that in New York City, the dynamics remain more complex, but the principle is the same: a balanced market attracts serious buyers and long-term stability. As some regions across the U.S. cool from the frenzied activity of the pandemic years, Duke Properties continues to prioritize steady investments in quality assets and resilient neighborhoods.

The shift toward a buyer’s market also underscores broader economic health. As affordability improves and sellers become more realistic with pricing, homeownership becomes attainable again for more Americans. “That’s the foundation of strong communities,” Dweck says. “At Duke Properties, we see opportunity not in chasing trends, but in understanding them—and this transition shows that the real estate market is finding its balance again.”